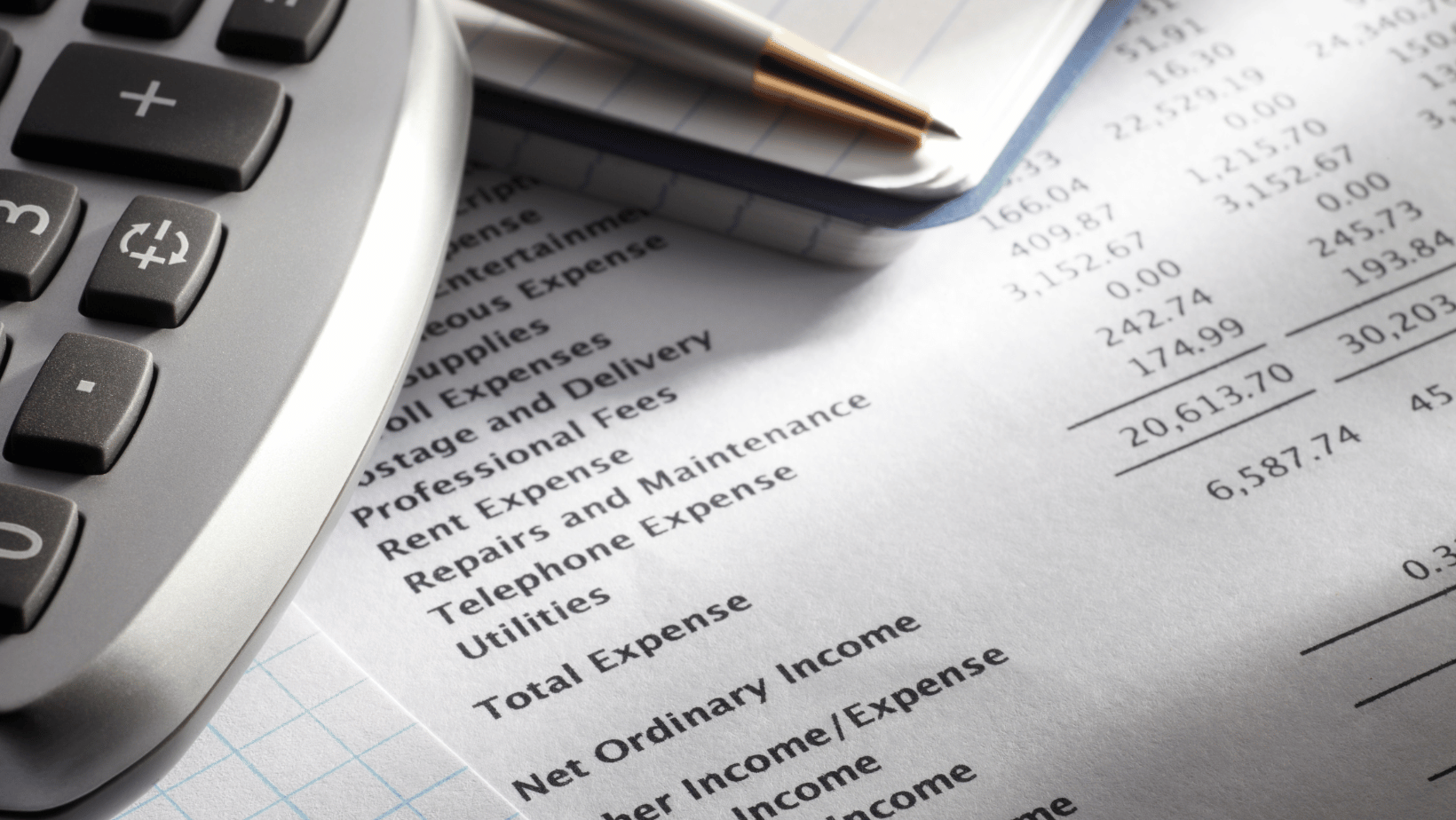

Tax planning is a vital aspect of financial management that enables individuals to maximize savings and minimize stress come tax season. By understanding tax laws, taking advantage of available deductions and credits, and implementing strategic tax-saving strategies, individuals can optimize their tax situation and keep more of their hard-earned money.

Firstly, stay informed about changes to tax laws and regulations that may affect your tax situation. Familiarize yourself with available deductions and credits, such as those for education expenses, retirement contributions, and charitable donations, and take advantage of them to reduce your taxable income.

Consider leveraging tax-advantaged accounts such as 401(k) plans, IRAs, health savings accounts (HSAs), and flexible spending accounts (FSAs) to lower your tax liability while saving for retirement or covering qualified medical expenses.

Plan your investments with tax implications in mind. Consider tax-efficient investment strategies such as investing in tax-deferred or tax-exempt accounts, tax-loss harvesting, and minimizing taxable investment income to reduce your tax bill.

Consult with a tax professional or financial advisor to develop a personalized tax planning strategy tailored to your financial situation and goals. They can provide valuable insights and guidance on maximizing tax savings opportunities while ensuring compliance with tax laws and regulations.

By taking a proactive approach to tax planning and implementing strategic tax-saving strategies, individuals can minimize stress, optimize their tax situation, and keep more money in their pockets for future financial goals and aspirations.