Financial literacy is essential for millennials as they navigate the complexities of money matters in the digital age. With technological advancements and changing economic landscapes, millennials face unique challenges and opportunities when it comes to managing their finances.

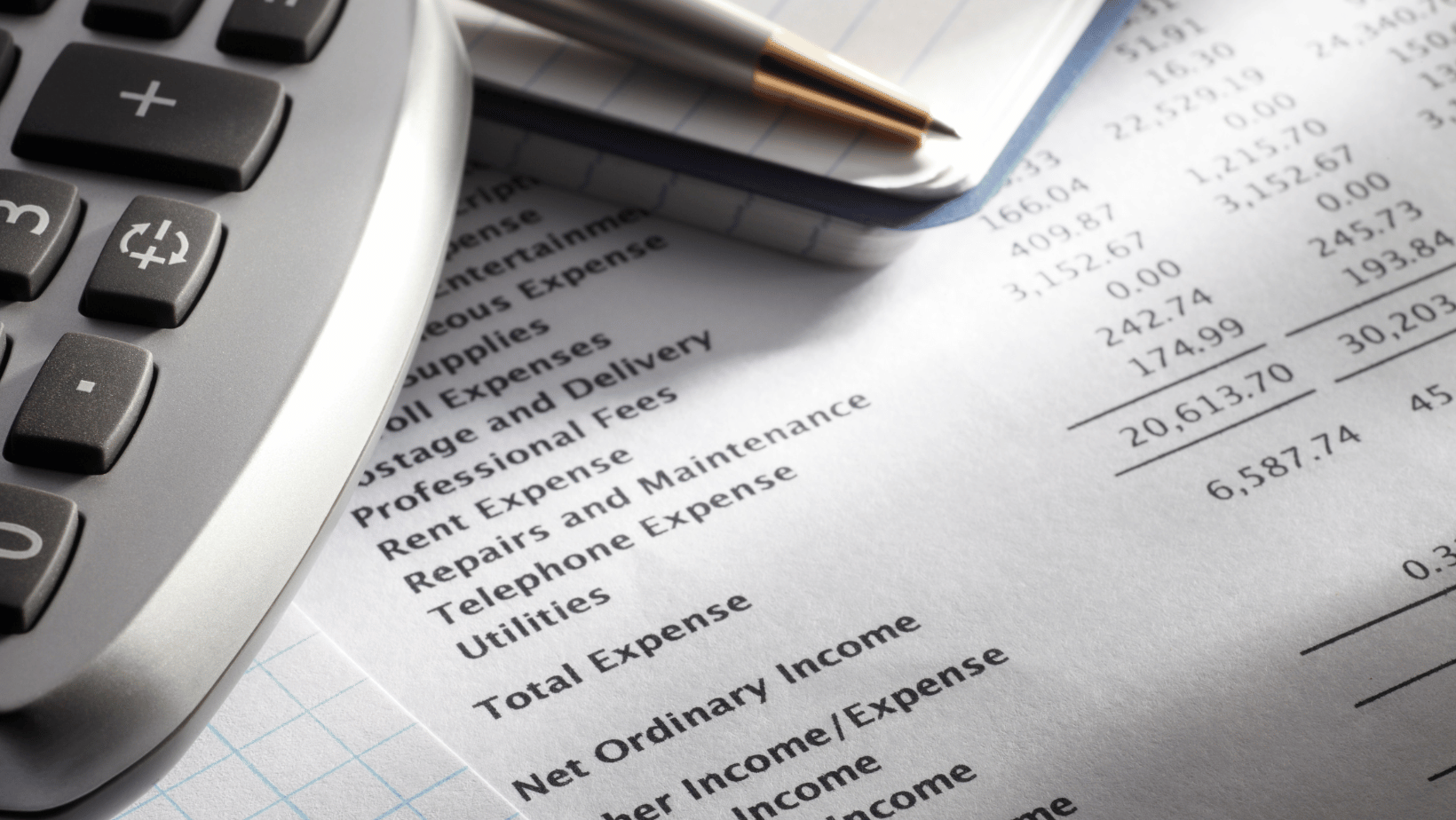

Firstly, it’s crucial for millennials to understand the basics of personal finance, including budgeting, saving, investing, and managing debt. Creating a budget and tracking expenses can help millennials gain control over their finances and make informed decisions about spending and saving.

In addition, millennials should familiarize themselves with digital banking tools and online financial platforms that can simplify money management and provide valuable insights into their financial habits. Mobile banking apps, budgeting apps, and investment platforms offer convenience and accessibility, allowing millennials to monitor their accounts, track expenses, and make financial transactions on the go.

Moreover, millennials should educate themselves about important financial concepts such as credit scores, interest rates, investment options, and retirement planning. Taking advantage of online resources, financial education courses, and workshops can help millennials improve their financial literacy and make smarter financial decisions.

Finally, millennials should prioritize building financial resilience and preparing for unexpected expenses or emergencies. Establishing an emergency fund, securing adequate insurance coverage, and planning for long-term financial goals such as homeownership and retirement can provide peace of mind and help millennials achieve financial security in the digital age.