Budgeting is a foundational skill for achieving financial success and security. It involves creating a plan for managing income and expenses to ensure that you can meet your financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund. Here’s a step-by-step guide to mastering the basics of budgeting.

Firstly, start by calculating your total monthly income from all sources. This includes salaries, wages, bonuses, and any other sources of income.

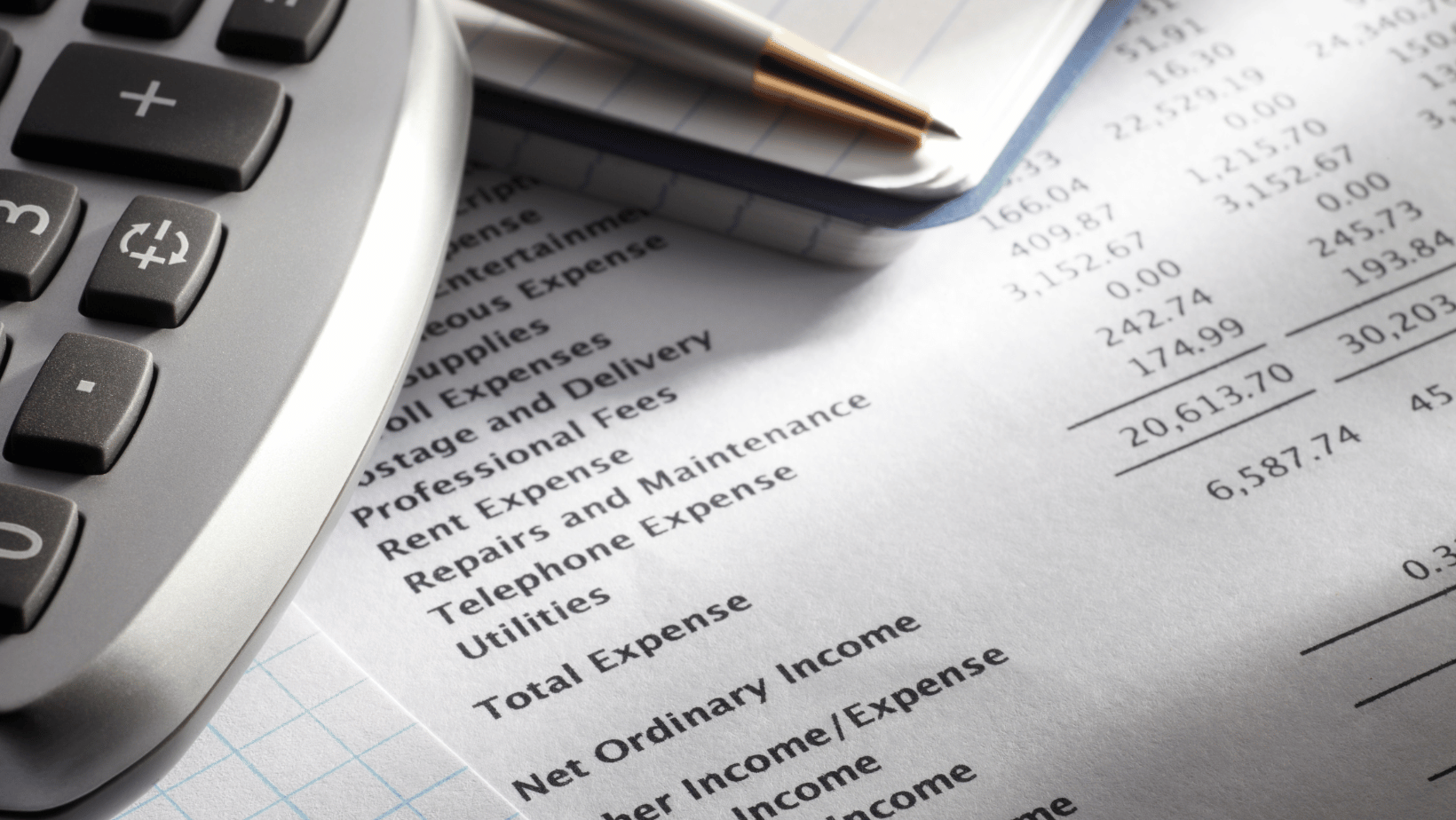

Next, list all your monthly expenses, including fixed expenses like rent or mortgage payments, utilities, insurance premiums, and loan payments, as well as variable expenses like groceries, entertainment, and transportation costs.

Once you have a clear picture of your income and expenses, subtract your total expenses from your total income to determine your discretionary income—the amount left over after covering your essential expenses.

Now, allocate your discretionary income towards your financial goals and priorities. This may include saving a portion for emergencies, paying off debt, investing for the future, and setting aside money for discretionary spending.

Regularly review and adjust your budget as needed to reflect changes in your income, expenses, and financial goals. By consistently sticking to a budget and making informed financial decisions, you can take control of your finances, reduce stress, and work towards achieving your long-term financial aspirations.