Retirement planning is essential for ensuring financial security and peace of mind in your golden years. It involves setting goals, making informed decisions, and taking proactive steps to build a nest egg that will support you throughout retirement.

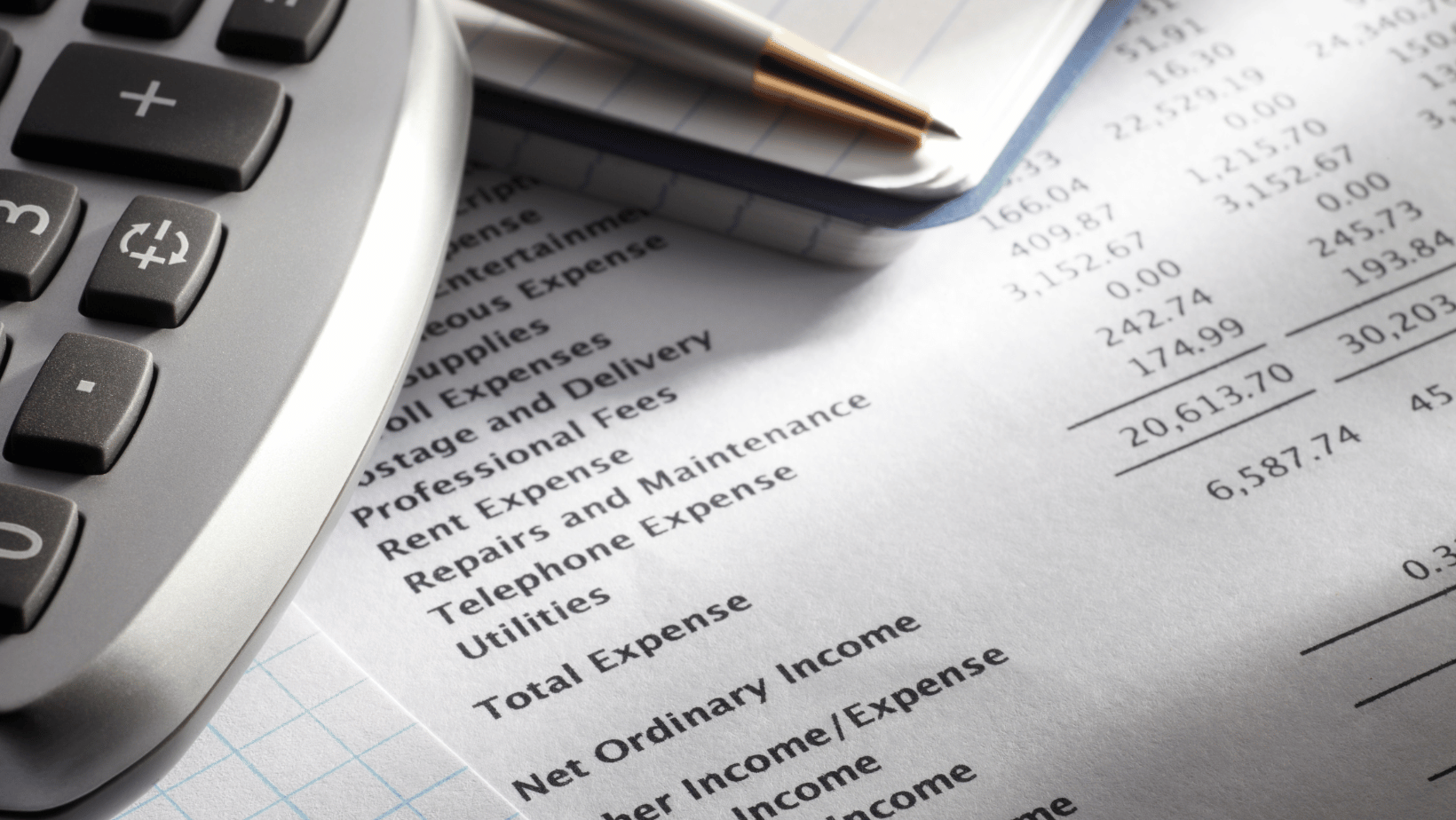

Start by estimating your retirement expenses, taking into account factors such as housing, healthcare, transportation, and leisure activities. Consider how inflation and potential healthcare costs may impact your expenses over time.

Next, assess your current retirement savings and determine how much you need to save each month to reach your retirement goals. Take advantage of retirement savings vehicles such as employer-sponsored 401(k) plans, individual retirement accounts (IRAs), and health savings accounts (HSAs) to maximize your savings potential and take advantage of any employer matching contributions.

Diversify your investment portfolio to mitigate risk and maximize returns. Consider allocating your investments across a mix of asset classes, such as stocks, bonds, mutual funds, and real estate, based on your risk tolerance and time horizon.

Regularly review and adjust your retirement plan as needed to account for changes in your financial situation, lifestyle goals, and market conditions. Consider consulting with a financial advisor to develop a personalized retirement plan tailored to your needs and objectives. By taking a proactive approach to retirement planning and consistently saving and investing for the future, you can enjoy a secure and fulfilling retirement free from financial worries.